Nc State Sales Tax Rate 2025. Prescription drugs are exempt from the north carolina sales tax;. North carolina has a reduced rate for qualifying food of 2%.

North carolina’s general sales tax rate is 4.75%. The base level state sales tax rate in the state of north carolina is 4.75%.

Our free online north carolina sales tax calculator calculates exact sales tax by state, county, city, or zip code.

Plan would redistribute NC sales tax revenue Raleigh News & Observer, North carolina has recent rate changes. 2025 rates included for use while preparing your.

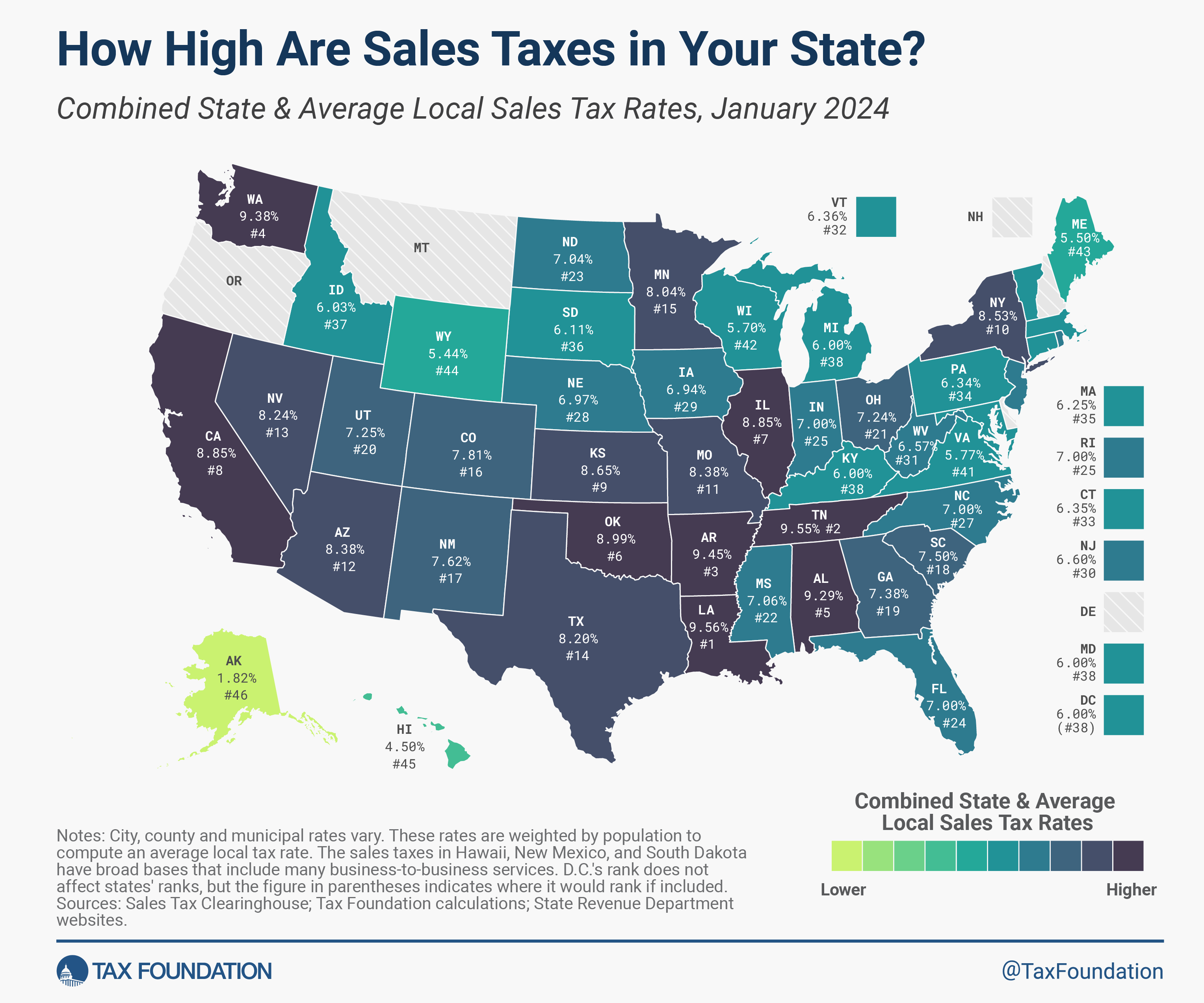

Nc State Sales Tax Rate 2025 Caryn Cthrine, Additional sales tax is then added on depending on location by local government. There are a total of 460 local tax jurisdictions across the state, collecting an average.

North Carolina Sales Tax Calculator Step By Step Business, Project 2025 proposes major government changes if a republican wins the 2025 election, drawing both criticism and praise. 2025 rates included for use while preparing your.

Ultimate North Carolina Sales Tax Guide Zamp, This table lists each changed tax jurisdiction, the amount of the change, and the towns. North carolina’s general sales tax rate is 4.75%.

Printable Sales Tax By State Chart, The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been. There are a total of 460 local tax jurisdictions across the state, collecting an average.

State Sales Tax To What Extent Does Your State Rely on Sales Taxes?, Sales and use tax bulletins 01/01/2025 page 26. 829 rows north carolina has state sales tax of 4.75%, and allows local governments to collect a local option sales tax of up to 2.75%.

North Carolina Sales Tax Calculator US iCalculator™, The state sales tax rate in north carolina is 4.75%, but you can customize this table as needed to reflect your applicable local sales tax rate. The state sales tax rate in north carolina is 4.750%.

North Carolina Tax Rates & Rankings North Carolina Taxes, Additional sales tax is then added on depending on location by local government. North carolina state tax includes a flat personal income tax rate of 4.5%.

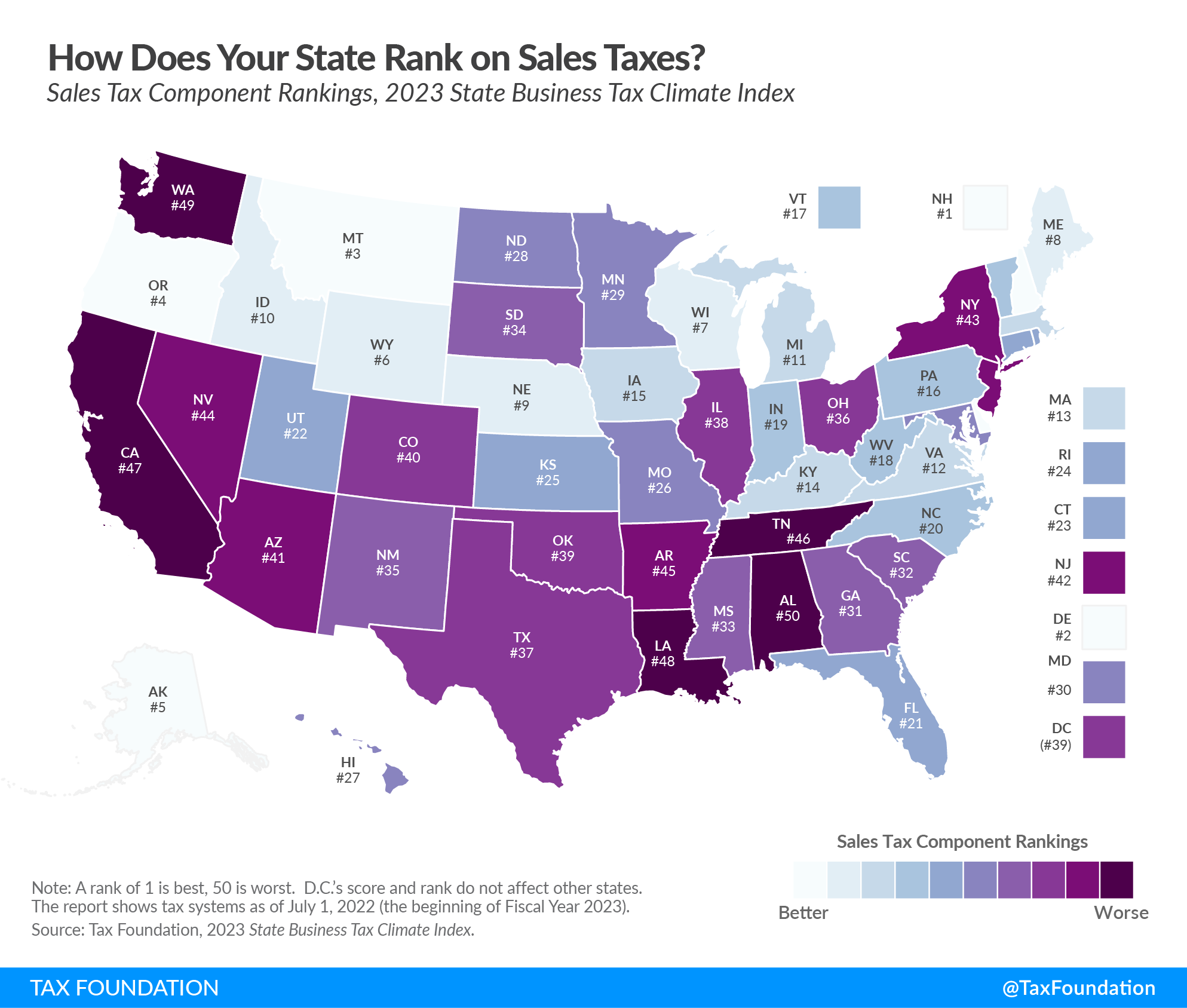

Ranking Sales Taxes How Does Your State Rank on Sales Taxes?, Effective for taxable years beginning on or after january 1, 2025, the personal income tax rate is gradually lowered from the current. North carolina has a 2.5 percent corporate income tax rate.

State & Local Sales Tax by State, For taxable years beginning in 2025, the north carolina individual income tax rate is 4.25%. Additional sales tax is then added on depending on location by local government.