Tax Exempt Form 2025 Indiana. The information displayed is based on the available information. Welcome to the indiana department of revenue.

On may 4, 2025, indiana governor eric holcomb approved sb 419, which, effective january 1, 2025, exempts from indiana adjusted gross income compensation received. Save on lodging taxes in exempt locations.

On may 4, 2025, indiana governor eric holcomb approved sb 419, which, effective january 1, 2025, exempts from indiana adjusted gross income compensation received.

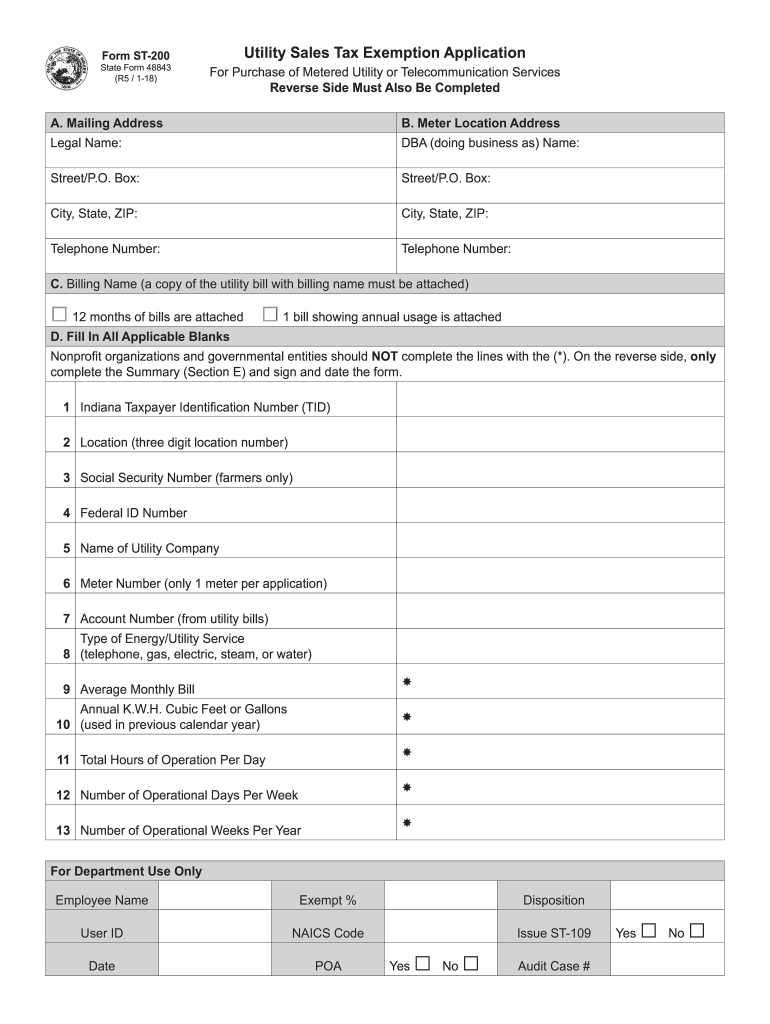

Indiana sales tax Fill out & sign online DocHub, The information displayed is based on the available information. Use this 2025 form to obtain services/goods sales tax exempt.

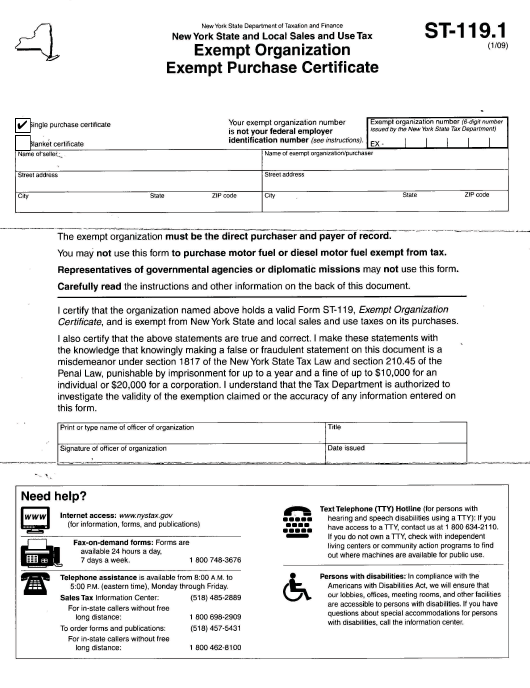

FREE 10 Sample Tax Exemption Forms In PDF, Forms downloaded and printed from this page may be used to file taxes unless otherwise specified. W4 tax form 2025 spanish lilas carmelle, the direct file pilot is closed as of april 21, 2025.

Homestead related tax exemptions Fill out & sign online DocHub, Application for registration agricultural sales and use tax. Because delaware still allows taxpayers to take a deduction or a.

Farmers Tax Exempt Certificate Farmer Foto Collections, On may 4, 2025, indiana governor eric holcomb approved sb 419, which, effective january 1, 2025, exempts from indiana adjusted gross income compensation received. Prior to july 1, 2025, a nonprofit organization registered with the indiana department of.

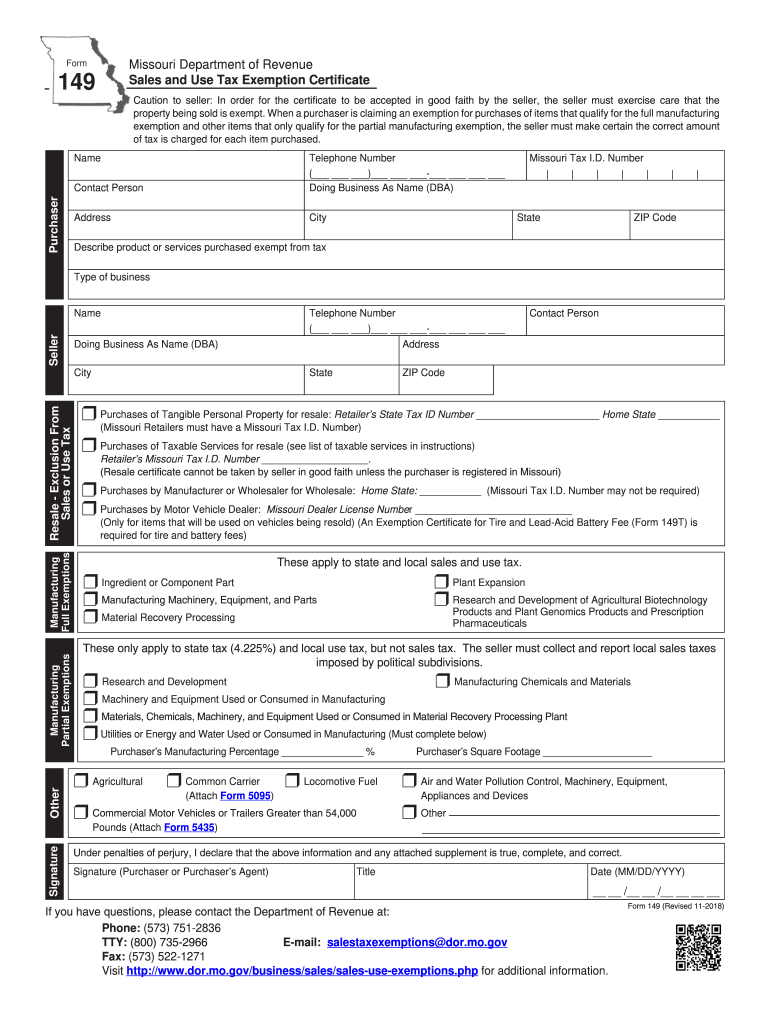

149 Sales Tax Exemption 20182024 Form Fill Out and Sign Printable, Beginning in 2025 indiana nonprofits will begin. The indiana department of revenue (dor) is now accepting filings for the 2025 individual income tax season, along with the internal revenue service.

Texas Sales and Use Tax Exemption Certification Forms Docs 2025, W4 tax form 2025 spanish lilas carmelle, the direct file pilot is closed as of april 21, 2025. State tax exemptions provided to gsa smartpay card/account holders vary by state.

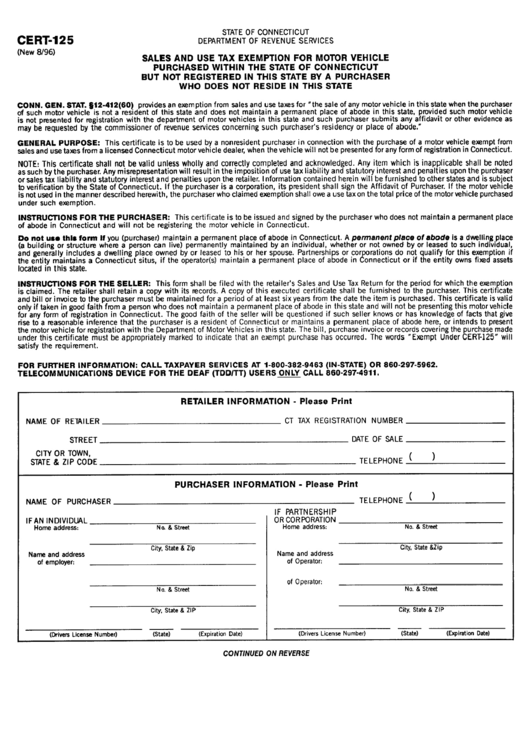

Ct Sales And Use Tax Exempt Form 2025, Application for registration agricultural sales and use tax. Find federal tax forms (e.g.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Hb 1002, enacted in 2025, lowered the personal income tax rate from 3.23% to 3.15% for tax years 2025 and 2025. Application for sales and use tax exempt entities or state and federally chartered credit unions.

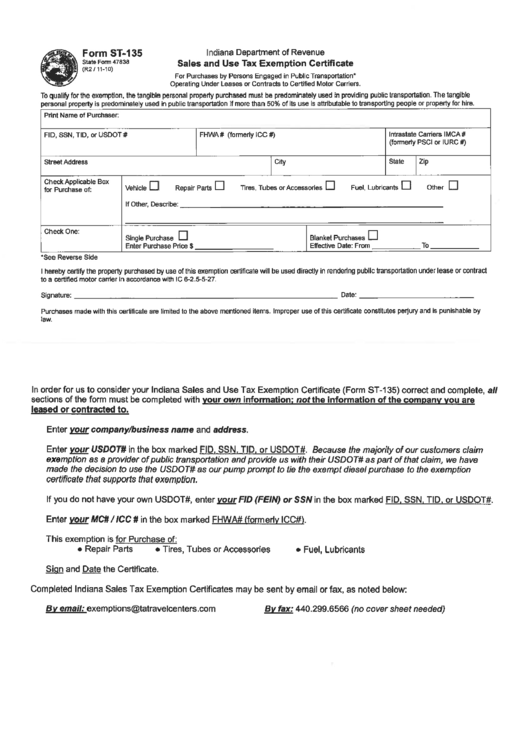

Indiana Department Of Revenue Sales And Use Tax Exemption Certificate, The form typically requires details like your rrmc number, filing period, total sales,. Forms downloaded and printed from this page may be used to file taxes unless otherwise specified.

Indiana Sales And Use Tax Exemption Form, The deadline is for taxpayers, including. State tax exemptions provided to gsa smartpay card/account holders vary by state.